Blue Ocean Strategy

On the fringe of the two dominant orthodox models (the market-based and resource-based theories) several frameworks have been introduced. They’ve not all made it through. However some frameworks (eg. Blue Ocean Strategy by W. Chan Kim & Renée Mauborgne or Delta model by A. Hax) are becoming popular and are considered valid alternatives or at least good supplements to the dominant models.

In Hax’s words ( [Hax01] ) :

„the most respected and popular strategy development frame- works have associated ’strategy’ with competitive advantage”

As a result, the dominant orthodox models:

put competitors and rivalry as the principal centre of attention, strategy is war, success is conceived as beating someone,

are anchored in the past: the factors that did shape the current structure of the industry tend to be overestimated, which limits outside-the- box thinking prevents step changes,

focus on competition and foster imitation: the attributes of our products are inspired and copied from the market leaders, which sooner or later drives the convergence of the industry toward commoditisation.

Focus on Customers Not on Competitors

With Blue Ocean Strategy customers and not competitors should be the centre of attention:

„using competitors as a benchmark leads to sameness and sameness will never lead us to greatness. By contrast, we should experiment and engage in a continuous learning process that propels us into uncharted territory ” ([Hax, 2001]).

The objective is no longer to obtain a competitive advantage vis-à-vis competitors, but to achieve customer bondings: to deeply understand customers, recognise their differences and create a value proposition that uniquely meet each customer’s needs.

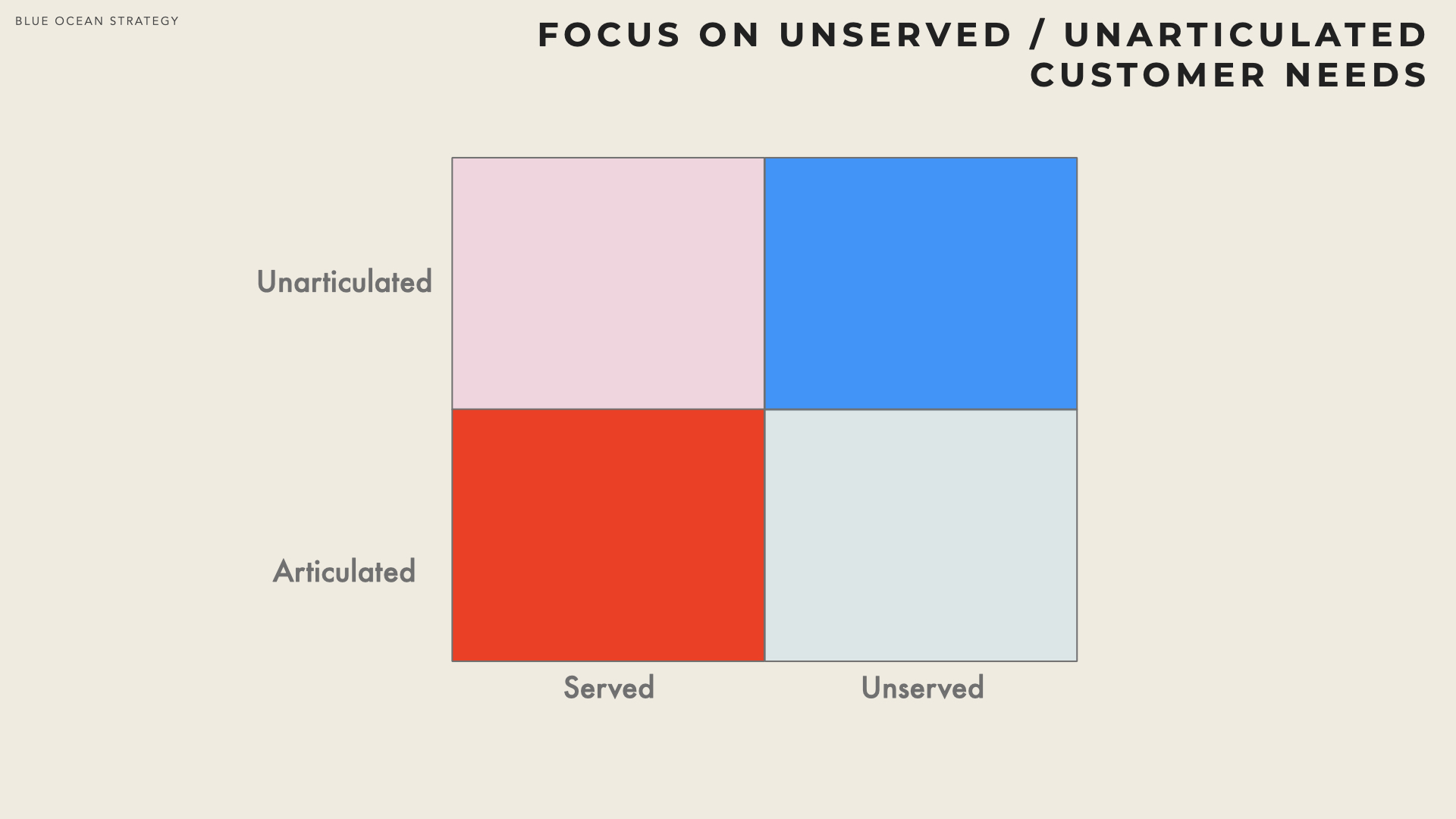

Discovering uncontested Market Space

According to W. Chan Kim & Renée Mauborgne ( [Mauborgne05] ) a firm can manage to both establish itself and become successful even in a declining industry, in an industry in which traditional strategic analysis would conclude to very limited potential growth. This can be achieved by creating an uncontested new market space that makes the competition irrelevant.

„Red oceans will always be a fact of business life and will always matter. The ability to swim successfully in the red ocean and outcompete rivals will remain key for most players. However, to seize new profit and growth opportunities, company need to go beyond competing and to create blue oceans”. [Kim & Mauborgne]

Blue Ocean thinking encourages entrepreneurs and managers to be different by finding or creating market spaces that are not currently being served. Unveiling a Blue Strategy is not straightforward (it is a lot easier to explain ex-post why a strategic move actually unveiled a Blue Strategy). However, the Blue Ocean Strategic Canvas help develop strategies based on creating new market spaces

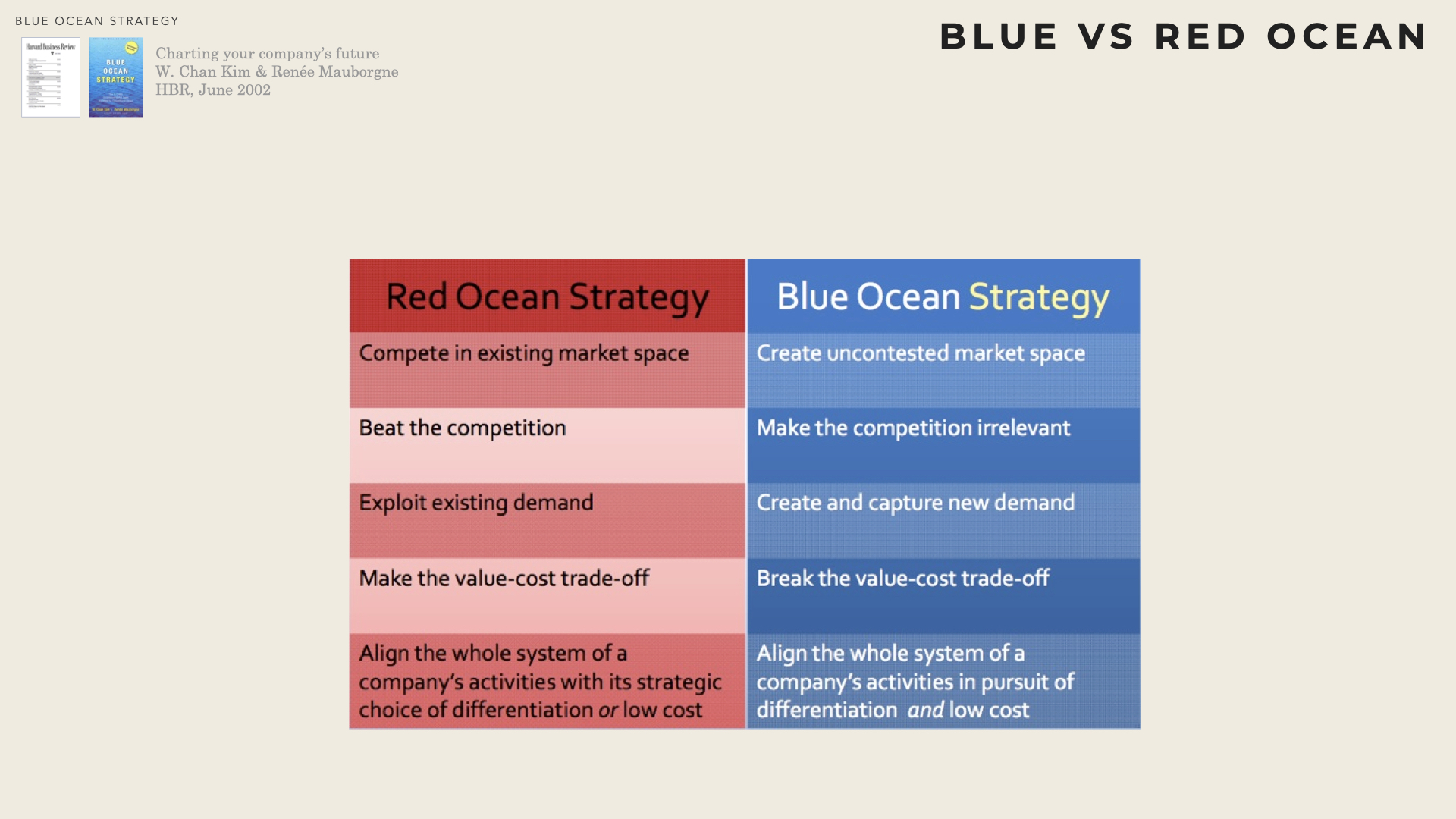

Red oceans represent all the industries in existence today (i.e. the known market place) whereas Blue Oceans denote all the industries not yet in existence today. Instead of focusing on beating competition, they focused on making competition irrelevant by creating a leap in value for buyers and the company.

In red oceans, industry boundaries are pre-defined and the competitive rules of the game are known: companies try to outperform their rivals to grab a greater share of existing demand. Competition-based ’Red Ocean Strategy’ assumes that an industry’s structural conditions are given and that firms are forced to compete within them. Blue oceans in contrast, correspond to untapped market space, demand creation and the opportunity for highly profitable growth. Market boundaries & industry structure are not given and can be reconstructed by the actions & beliefs of industry players.

Firms that create Blue Oceans seem to adopt different strategy logic. Instead of looking for better solutions to the problem, they redefine the problem itself. This is achieved by breaking market boundaries and the usual value-cost trade-off.

Value innovation is created when a company affects both its cost structure and its value proposition to buyers. Buyer value is increased through creating elements the industry has never offered or raising some attributes of the existing offerings. Cost saving are made by eliminating and reducing the factors an industry competes on.

Over time costs are reduced even further as high sales volumes can drive economies of scale. Value innovation places equal emphasis on value and on innovation.

Value w/o innovation tends to focus on value creation on an incremental scale (insufficient to make a company stand out in the market place). Innovation without value tends to be technology-driven, futuristic and often overshooting beyond what buyers are ready to accept and pay for.

Value innovation occurs only when companies align innovation with utility, price and cost positions. If they fail to anchor innovation with value, technology innovators & market pioneers often lay the eggs that the other companies hatch.

Value innovation defies the commonly accepted dogma that companies can either create greater value at a higher cost or create reasonable value at a lower cost. Strategy is seen as making a choice between differentiation and low cost. In contrast, Companies that seek to create Blue Oceans will pursue simultaneously differentiation and low cost.

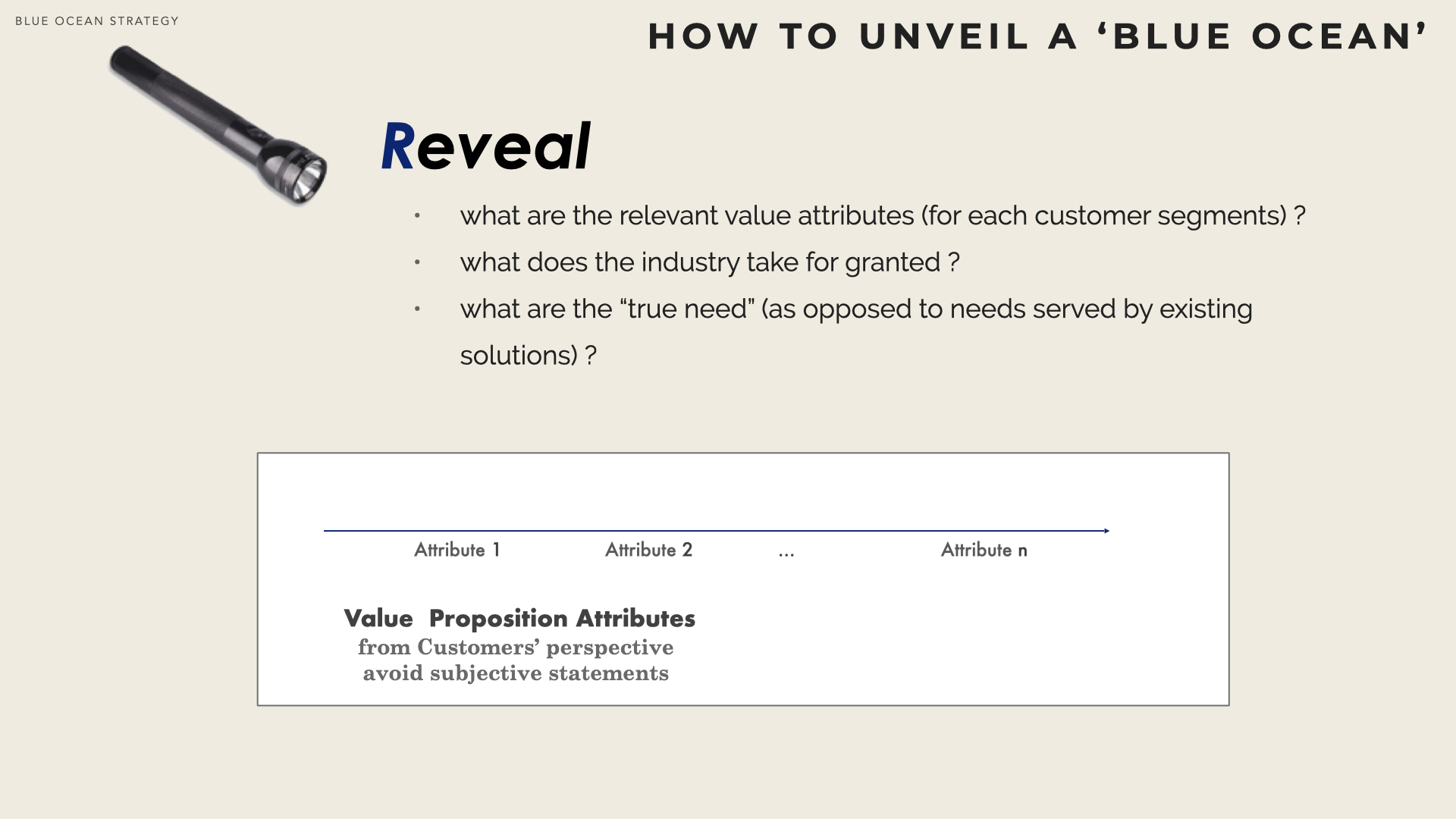

Reveal: factor that are taken for granted

The first step of the Blue Ocean Strategic Canvas aims to reveal what are the factors that the industry takes for granted (i.e. that are implicitly associated to a product). This is one of the most delicate steps, as more often than not, this is so implicit that we can easily fail to recognise such factors. A good approach consists in considering current products and listing all their attributes, for instance through ’brown paper’ brainstorming. An attribute that is consistently offered by all the players (regardless of their strategic group) is possibly a factor that is taken for granted.

Discovering which are the relevant factors is one of the main (if not the main) difficulties. Focussing on the right number of factors is also crucial : too few factors and the value curve is biased, too many and it becomes unusable.

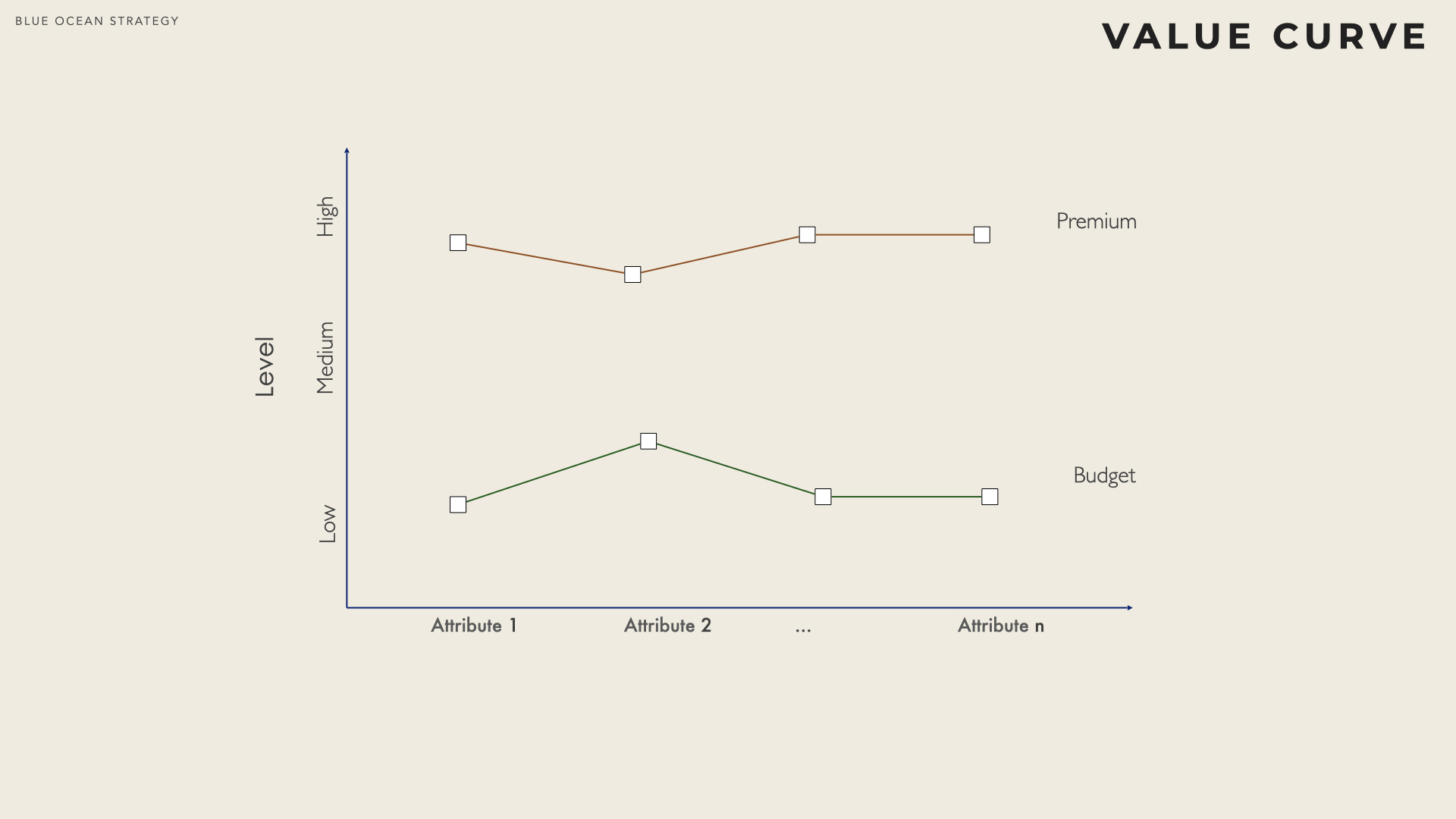

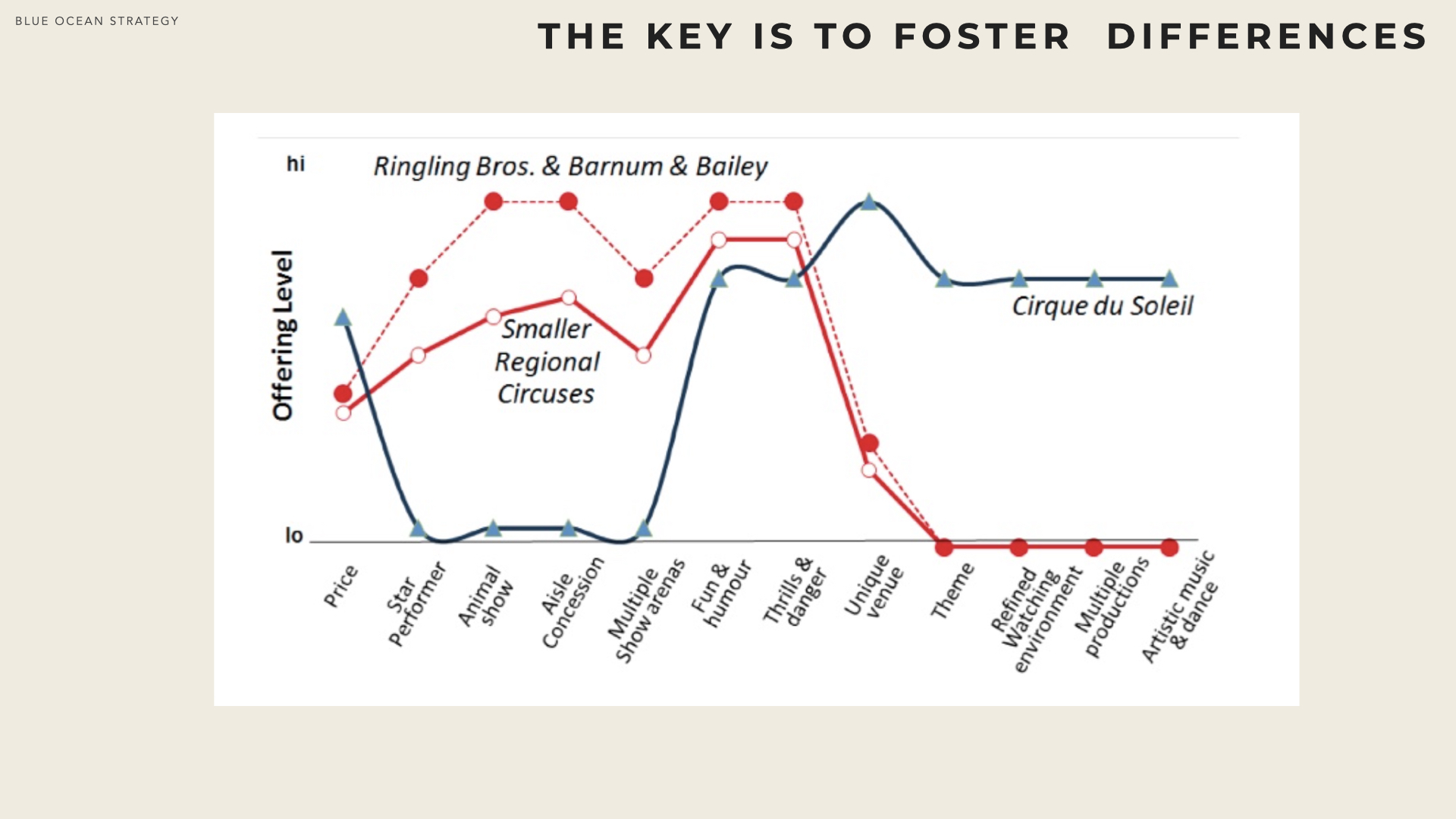

The value curve

A value curve is a graphic depiction of a company’s relative performance across the factors of competition in its industry. It captures the current state of play in the known market space (i.e. the factors the industry is currently competing and investing) along the full customer experience (sales, product, service).

The level of performance is more qualitative than quantitative. Sketching the value curves of the various strategic groups is what matters. Even in an industry that encompasses many players, there is usually a lot of convergence in the various value curves from the buyer’s perspective. A typical canvas will shows the classical differentiation and low cost strategies.

Premium products are priced high and present a high level of offering across all the key competing factors. From the buyers’ standpoint products are all different in the same way. By contrast, budget products are priced low and are also low across all the key competing factors.

Divergence from existing value curve

Once the various existing reference value propositions are depicted, one can seek to build a new value proposition by offering a very distinct mix of attributes.

Very often the budget and premium value curves share a similar basic shape but at different altitude. A diverging value proposition is therefore usually very distinctive.

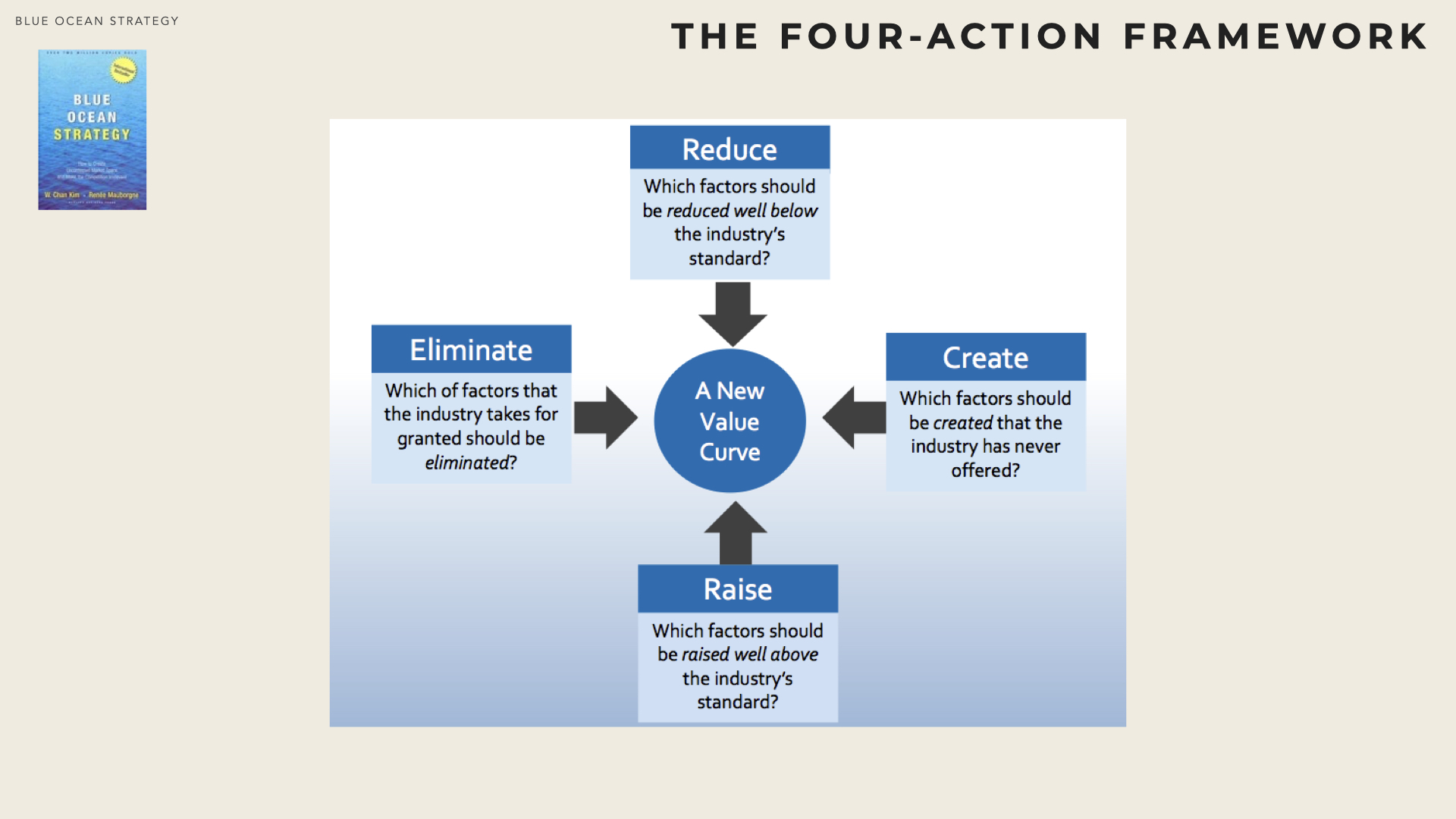

The Four Action Framework

To fundamentally shift the strategy canvas of an industry, the focus must be changed from competitors to alternatives and from customers to non-yet-customers.

Four actions can be used to reconstruct buyer value elements in crafting a new value curve.

Eliminate - some of the factors that the industry usually offer. Often these factors are still taken for granted even though they may no longer contribute to any value. They are the factors that are been taken for granted, and whose relevance is never questioned.

Reduce - some factors well below the industry’s standard. More often than not, products & services have been over-designed in the race to match & beat competition. Eliminating & reducing factors help dropping the cost structure vis-à-vis competitors.

Raise - some factors well above the industry’s standard. Uncover & eliminate the compromises your industry forces customers to make.

Create - additional factors that the industry has never offered. Discover entirely new sources of value for buyers. Raise & Create lift buyer value and create new demand.

Explore Alternative across boundaries

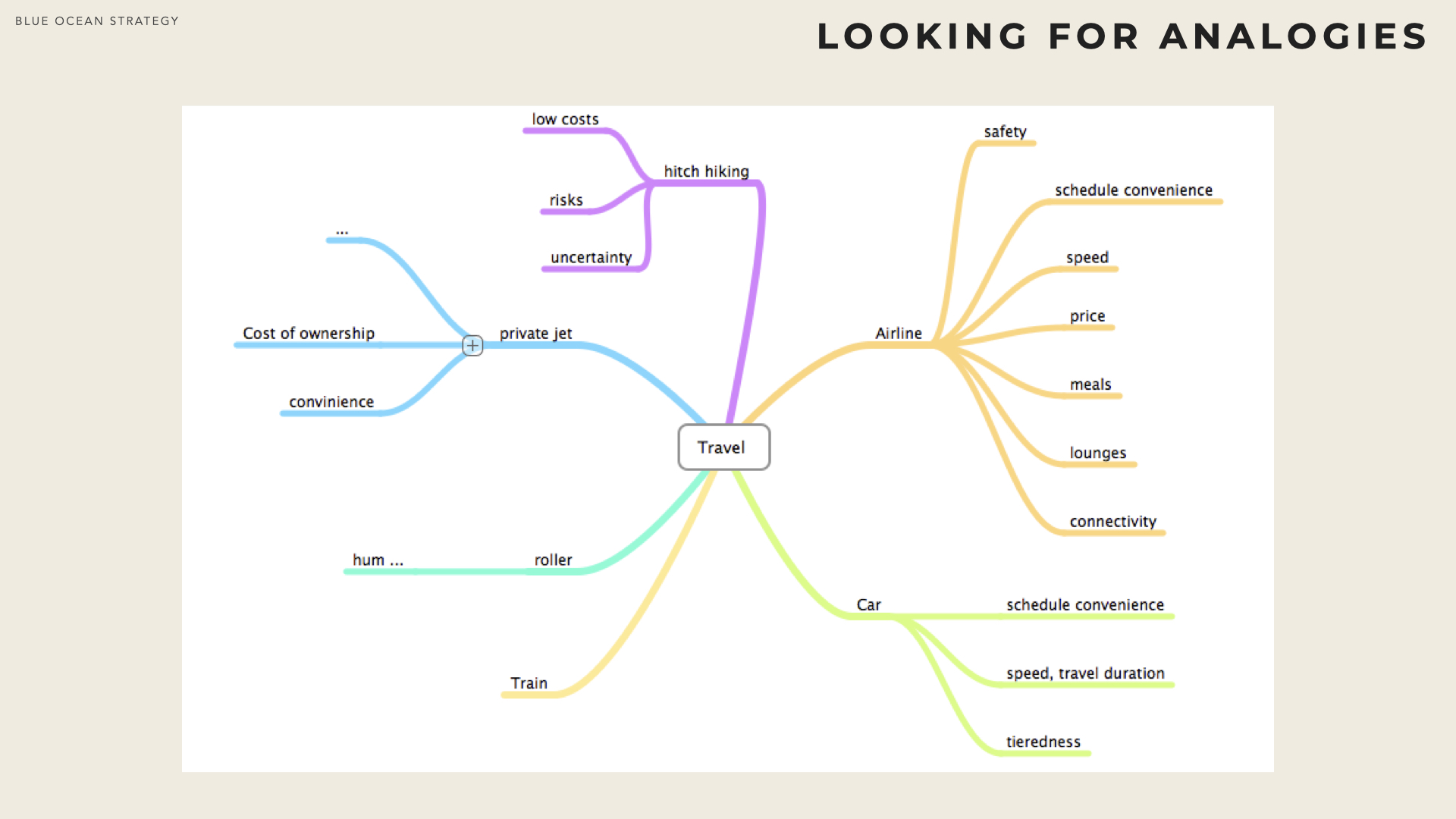

In making purchase decision, buyers (possibly explicitly) consider various alternatives, i.e. substitutes (products that belong to the same industry) but also products that serve the same purpose, although they may have different functions and forms.

Exploring why and how customers trade across alternatives (what do they value, how do the chose) usually uncover additional factors. Outside-the-box thinking is crucial at that stage, not only different industry should be explored, but also different categories of ’buyers’ (the purchaser, the user, the influencer, etc) and different customer groups.

The objective at that stage is to discover new factors that current industry is not considering. However, it doesn’t mean that all factors should be kept for strategy elaboration. On the contrary, the effort should not be diffuse across all key factors of competitions. The value curve should clearly show the few factors where the emphasis is put.

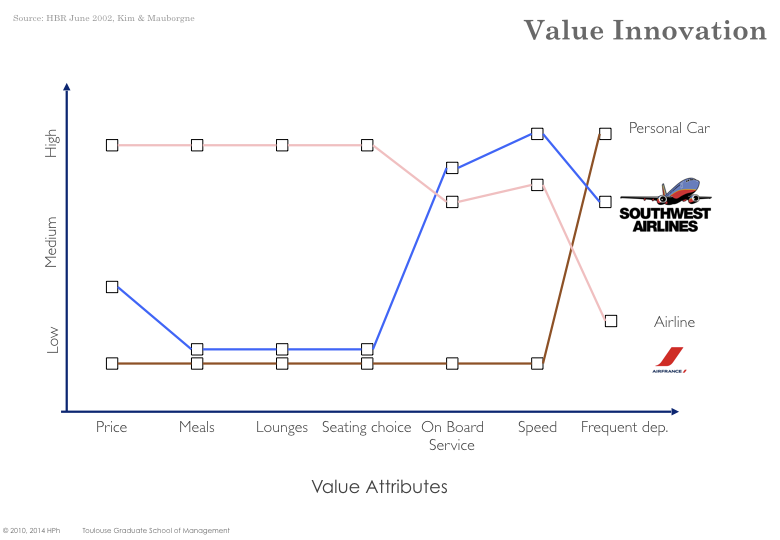

Example: Southwest’s value curve

Southwest (one of the first low cost airline and certainly the most profitable airline for the last forty years) built its value curve by considering the other established airlines but also transport alternatives such as the car.

Southwest’s value curve was made divergent by :

- Reducing Prices,

- Eliminating Meals, Lounges, Seating Choice (no-frills airline)

- Increasing Friendly service and fun, speed

- Creating Frequent departure (point to point, high frequency)

For further Study

The Blue Ocean Strategy web site offers valuable training materials.

Value Innovation in Fragmented Industries

A fragmented industry is composed of a large number of rather small firms. It may be the sign that the industry is nascent (still in development) and will soon consolidate.

It may as well correspond to an industry that is structurally prone to fragmentation, for instance due to : a lack of economies of scale (no cost advantage to large scale), high levels of customisation (doesn’t fit standardised, mass production), brand loyalty playing in favour of local players (intuitu personae relationship). In addition, entry barriers are likely to be low, which means a flow of new entrants may keep the industry fragmented.

Structurally fragmented industries are good candidates for value innovation and Blue Ocean Strategies. It takes new players to figure out how to offer more value to (some) customers while creating meaningful economies of scale and brand reputation.

Value innovators usually seek to limit their upfront investment and therefore, chaining and franchising are their two preferred entry modes.

Chaining consists in obtaining a cost advantage by establishing a network of additional locations – that the company owned – that is operated as a whole (e.g. through the deployment of advanced information systems). For instance, Starbuck is known for pursuing a chaining strategy : opening new stores (more than 20 000 in 63 countries) where it offers the very same value proposition.

Franchising is similar in many respects, except than rather owning stores, the innovator – the franchisor – licenses the right to open and operate a new location to a third party – the franchise – who must stick to stick to strict operating rules (including image & communication).

Merger and acquisition is also one of the possible avenue to consolidate a fragmented industry. However it remains a very risky road and success is far from being guaranteed.